ECONOMIC TRUCKING TRENDS: Trailer orders weaken, but trucking conditions improving

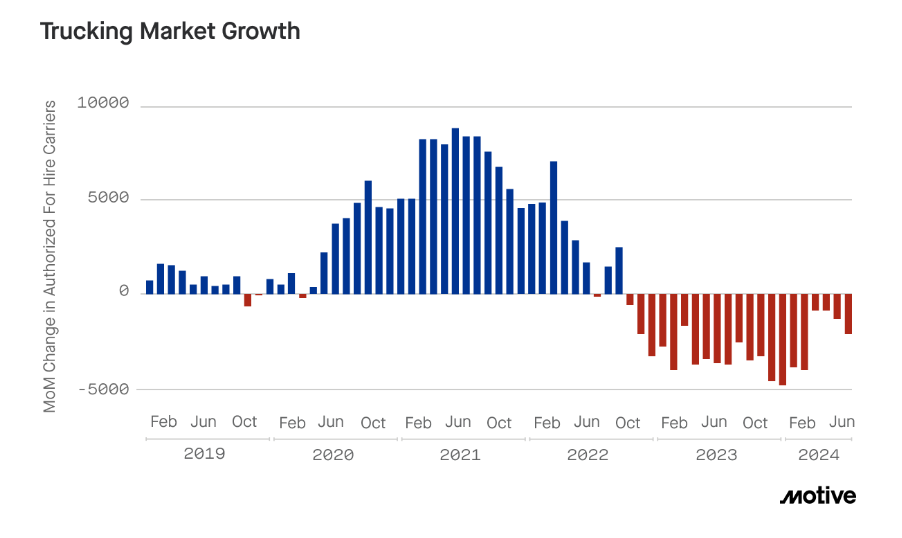

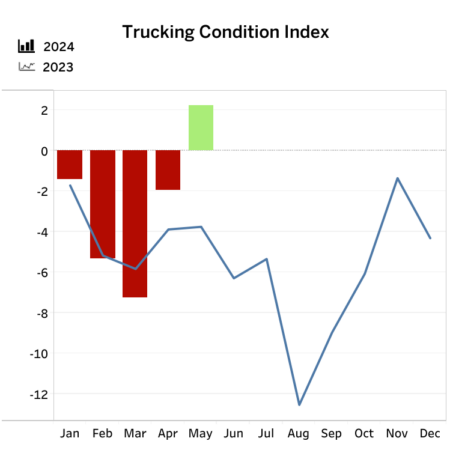

The trucking market continues to improve, with the Trucking Conditions Index returning to positive territory and Motive declaring an approaching end to the persistent freight recession.

But improving conditions aren’t sending fleets to trailer dealers. The latest order numbers plummeted in June as fleets are expected to direct their capex to power units ahead of the costly EPA27 emissions rules.

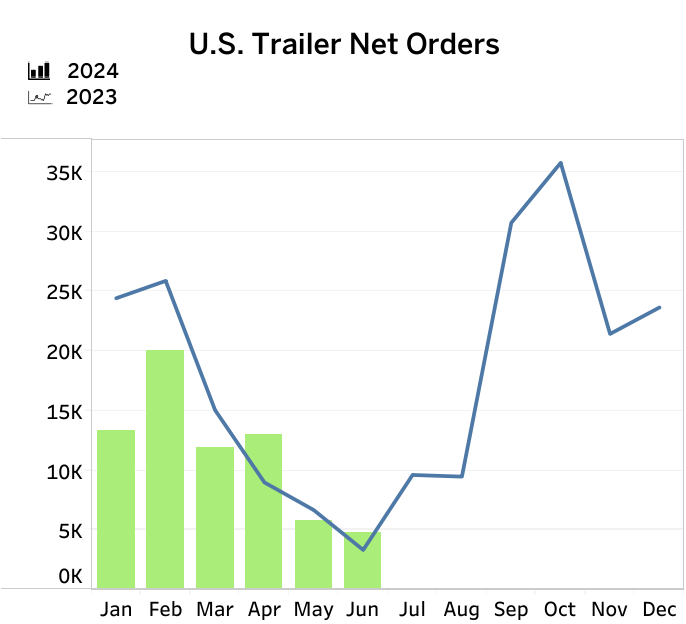

Trailer orders plummet

Trailer orders continue to plummet, with June numbers 17% down from May at 4,788 units, according to FTR. That total is 71% off the monthly average over the last 12 months.

Cancellations as a share of gross orders remained above 30% and the backlog-to-build ratio fell to 5.6 months, the second lowest it’s been since 2020.

“The U.S. trailer market faces significant challenges, primarily due to the stagnant truck freight/rate environment,” explained Dan Moyer, senior analyst, commercial vehicles with FTR. “Additional near-term potential factors may limit the total trailer market’s growth potential/recovery, including high dealer inventory levels, elevated pricing on inventoried units, and falling used trailer values. The opening of 2025 order books later this year along with the beginning of a potential truck freight recovery may improve market conditions. Meanwhile, OEMs will need to manage production cautiously.”

ACT Research said this month’s data means there were 26,000 units ordered in the second quarter, a 14% contraction over Q2 2023. Year to date, trailer orders are down 24% from the same period last year.

“This year’s slower trailer orders are no surprise given the elevated order velocity of the past few years, and with continuing weak for-hire truck market fundamentals, and already-filled dealer inventories, it looks like trailer demand is likely to remain constrained for some time,” said Jennifer McNealy, director – commercial vehicle market research and publications with ACT. “That said, it is important to remember that for orders, we are now in the weakest months of the annual cycle, minimally suggesting there is no catalyst for stronger orders before the fall and the OEMs’ opening of their 2025 order books.”

She noted fleet profitability is expected to improve later this year, but that capital will most likely be directed toward the purchase of power units in advance of costly EPA27 emissions standards.

She added: “Industry anecdotes suggest that the ‘pause button’ is expected to remain pressed through the remainder of 2024. The industry’s largest segments remain under pressure, cancellations remain elevated as dealers and fleets recalibrate their needs, and external forces like the US presidential election, low used equipment prices, and high interest rates add to uncertainly into the near- and medium-term.”

Trucking conditions improving

Falling diesel prices and an improving rate environment saw trucking conditions return to positive territory in May, according to FTR’s Trucking Conditions Index (TCI). It reached the mark of 2.24, from -1.95 in April.

But FTR cautions the month is likely to be an outlier and it anticipates the index will return to negative territory through the remainder of the year.

“Trucking is in the initial stages of a recovery, although it might be months before market participants perceive much change,” said Avery Vise, FTR’s vice-president of trucking.

“A big piece of May’s positive TCI was lower fuel costs, but freight rates also were much less unfavorable for carriers than usual since the fourth quarter of 2022. We expect rates to be mostly stable overall through late this year with spot rates leading the way. However, the capacity overhang remains large and will delay anything that could remotely be called a rebound.”

The TCI tracks freight volumes, rates, capacity, fuel prices and financing costs.

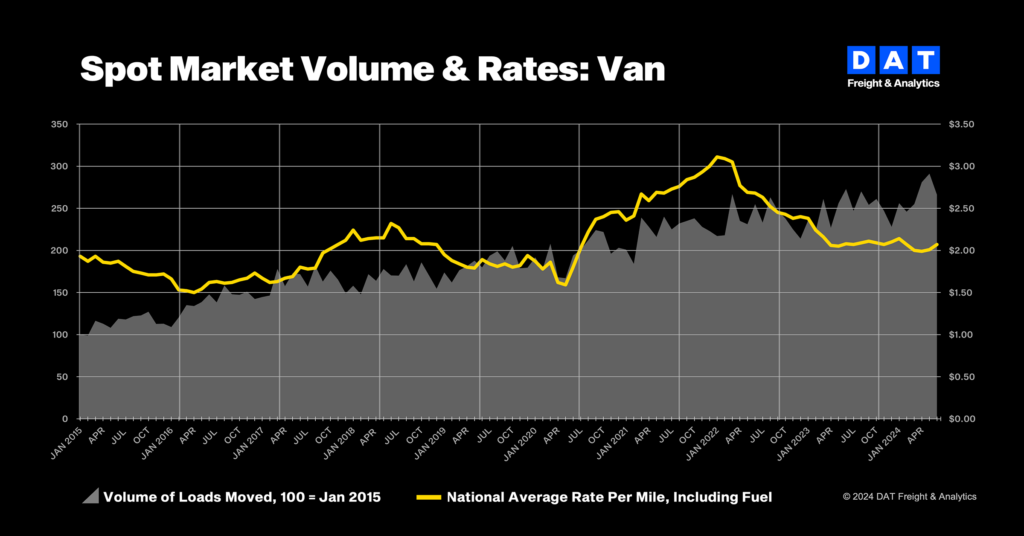

Spot market truckload volumes slipped in June

DAT Freight & Analytics reports that a strong May for truckload volumes was followed by a pullback in June. Van volumes on the spot market fell 9% from May, while reefer volumes pulled back 11% and flatbed 7%.

“The month ended strong for dry van freight, with nearly 25% more volume moving during the final week of June compared to last year,” said Ken Adamo, DAT chief of analytics. “While demand for trucking services entered July on a high note, we expect freight activity to ease during the summer. This remains a challenging market for freight carriers and brokers.”

The good news is that rates improved in the month; van rates by 6 cents/mile, reefer by 4 cents and flatbed by a penny. The load-to-truck ratios also increased for van and reefer segments.

Rates declined in latest week

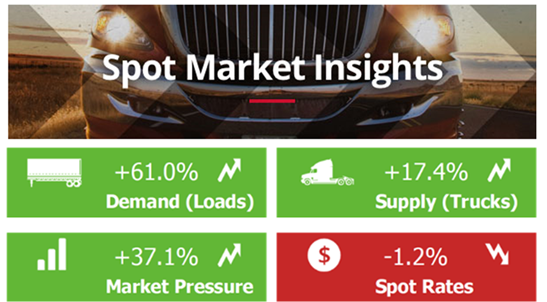

More recently, Truckstop and FTR Transportation Intelligence report the week ended July 12 saw spot market rates decrease from the previous week – not uncommon for mid-July. Rates were above prior-year levels for the first time since June 2022.

Dry van rates posted their strongest year over year increases since March 2022, despite falling from the previous week.

Volume growth outpaced the addition of equipment, strengthening the Market Demand Index to 74.5.

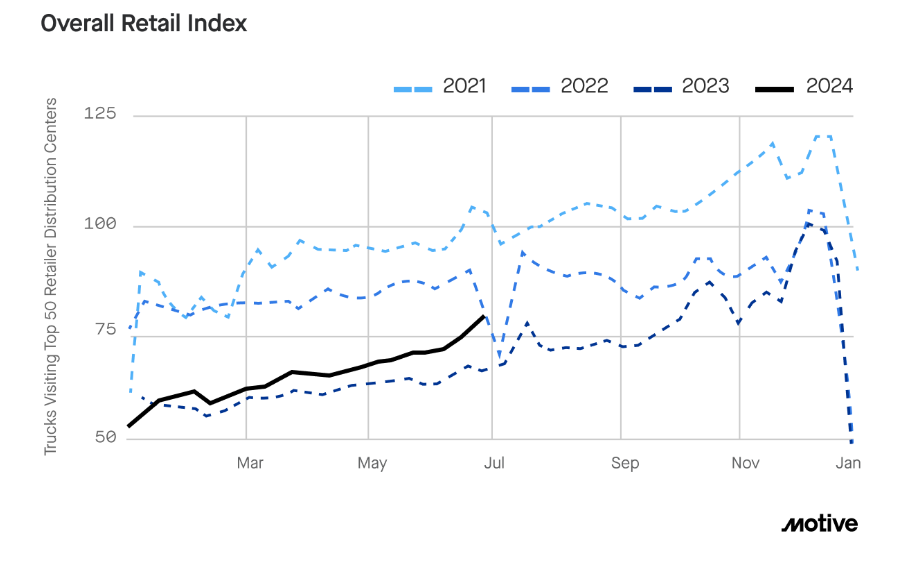

Stronger retail sales will drive trucking market improvements

Motive has put out its monthly economic report which contains good news for fleets serving the retail sector. It projects that retail sales will be higher this July than the same month last year, powered by the July 4 U.S. holiday and Amazon Prime Day sales.

The company also predicts retailers will aggressively restock inventory ahead of the end-of-year holiday season as they begin to feel the pinch of rising freight rates that will make last minute restocking more expensive. Ocean rates are already on the rise, Motive reports.

Most significantly, Motive reports “The freight recession is on its way out and the trucking market will steadily move in a positive direction in the second half of the year.”

The number of new entrants in the trucking space is stabilizing.

Motive’s Big Box Retail Index measures commercial vehicle visits to warehouses of the top 50 U.S. retailers. It jumped 10.8% in June from May numbers and 16% year over year. Motive says the jump is larger than usual, suggesting retails are predicting strong summer sales.

Top performing categories were department stores, apparel and electronics (up 32.9% year over year) and home improvement (up 24.4%).

Rates are returning to 2019 levels, Motive says. A total of 1,972 U.S. carriers left the market in June, a 60% increase from May.

“Rising trucking rates, trucking transportation job stability, and what we predict to be a very strong July across retail sales, especially brick and mortar, are all pointing to a rebounding freight market,” Motive concluded. “We predict this momentum will continue through the summer.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.